United Food and Commercial Workers

Local 152 Benefit Funds

Enrollment

If you have any questions regarding eligibility for coverage or if you have enrollment questions,

please call the Fund office at 1-800-555-4959, prompt 2.

SUMMARY PLAN DESCRIPTION

A SUMMARY PLAN DESCRIPTION (SPD) booklet is issued to all eligible participants and contains important benefit plan information. Since there are many variations of benefit plans, according to employment status (full-time or part-time), length of service and other factors, it is important to contact the Fund office for a SPD that provides a description of your specific benefits.

A SUMMARY PLAN DESCRIPTION (SPD) booklet is issued to all eligible participants and contains important benefit plan information. Since there are many variations of benefit plans, according to employment status (full-time or part-time), length of service and other factors, it is important to contact the Fund office for a SPD that provides a description of your specific benefits.

When there is a change in a benefit plan, the Fund office mails a SUMMARY OF MATERIAL MODIFICATIONS (SMM) to the affected participants. The SMM should be kept with your SPD since it contains information regarding changes and/or updates regarding coverage, eligibility and other items that occurred after the printing and mailing of the SPD. These changes typically occur after contract negotiations and/or as a result of changes in health care laws.

It is important to note that the language in the SMMs supersedes the language included in the SPD.

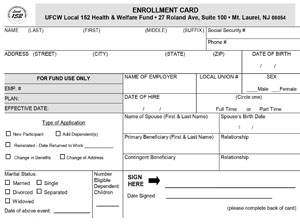

ENROLLMENT CARD

An Enrollment Card must be fully completed and submitted to the Fund office in order to ensure that benefits are made available as promptly as possible. When returning an Enrollment Card, it is important to send copies of all required documents such as marriage certificate and birth certificates. Please note that birth certificates must show the full name of both parents. Beneficiary information must also be completed.

An Enrollment Card must be fully completed and submitted to the Fund office in order to ensure that benefits are made available as promptly as possible. When returning an Enrollment Card, it is important to send copies of all required documents such as marriage certificate and birth certificates. Please note that birth certificates must show the full name of both parents. Beneficiary information must also be completed.

ELIGIBILITY PROVISIONS

REFER TO YOUR SPD TO DETERMINE

YOUR ELIGIBILITY FOR DEPENDENT COVERAGE OR A SPECIFIC BENEFIT.

THIS SUMMARY MAY CONTAIN A DEFINITION OR EXPLANATION THAT DOES NOT APPLY TO YOUR PLAN.

You are eligible to participate in this Plan if you are employed by a Contributing Employer who makes the necessary contributions on your behalf and in accordance with the Collective Bargaining Agreement between such Contributing Employer and Union.

You may be eligible for particular benefits based upon whether they are included under your Collective Bargaining Agreement. You may either contact the Fund Office or refer to your Collective Bargaining Agreement to determine which, if any, of the Benefits you may be eligible to receive.

You are covered by this Plan, upon completion of the stated eligibility period in the Collective Bargaining Agreement. Your eligible Dependents (if applicable) are covered by this Plan, upon completion of the stated eligibility period as set forth in the Collective Bargaining Agreement between your Employer and your Union. Such eligibility periods will be measured from your date of hire or date of promotion, whichever is applicable.

A Dependent means, in addition to yourself, any one of your eligible Family Members who is covered under the Plan as defined below. Benefits for each Dependent will be determined on the same basis as for you except where noted.

Notwithstanding anything in the SPD to the contrary, effective January 1, 2011, a Dependent includes your natural child, stepchild, or adopted child (or a child placed for adoption with you) who is under age 26 and who is not eligible for employer-based health insurance coverage (except coverage provided by the Fund).

| 1. | Your legal Spouse provided You are not legally separated from the Spouse (or do not have a "divorce from bed and board" from the Spouse). (Individuals in a “common law” arrangement are not considered legal Spouses under the Plan.) |

| 2. | Your (natural) child, legally adopted child, or a child placed in Your home for adoption who is under the age of 26. [For the purpose of this definition, the term child also includes a stepchild or foster child.] If your coverage is determined to be "grandfathered" as provided in your Summary of Benefits Insert, your child will not be eligible if such child is eligible to receive other employer-sponsored health coverage (other than a parent’s coverage). Any child who is eligible to be covered as a participant cannot be covered as a dependent. |

| 3. | A child considered by the Trustees to be an “alternative recipient” under the terms of a qualified medical child support order (QMCSO). |

| 4. | Your unmarried child who is age 26 or older and who otherwise meets the requirements above (other than age) and who is currently physically or mentally incapable of self-support and was so upon attaining age 19. Extended coverage for disabled children will continue only while your coverage is in force and the child remains unmarried and physically or mentally incapable of self-support. In order to be eligible for extended coverage, the Fund Office must receive medical proof of incapacitation, satisfactory to the Trustees, at least 60 days before the child’s 19th birthday and you must continue to provide such proof by December 31 of each year. A failure to do so will cause your child’s benefit to terminate when the child reaches age 26. |

Termination of Benefits

Termination of Participant Eligibility - You (the Participant) will automatically cease to be eligible for coverage at midnight on the first to occur of the following dates:

| 1. | The last day of the month preceding a month for which a participating employer is not obligated to make a contribution for You, and/or You are not eligible under any extension of benefits provision and/or You have COBRA entitlement but fail to make the required payment by the specified date explained in the “COBRA Continuation Coverage” Section of this benefit booklet; |

| 2. | The date the Fund notifies Your employer of termination of coverage as a result of being delinquent in Contributions to the Fund; |

| 3 | The date the Plan is terminated; |

| 4. | The date You enter the armed forces of any country; |

| 5. | The date of Your death; or |

| 6. | The date Your Employer no longer makes Contributions to the Fund. |

Termination of Dependent Eligibility - A dependent’s eligibility will automatically cease on the first to occur of the following dates:

| 1. | The date the Participant’s eligibility terminates for any reason other than death; |

| 2. | The last day of the month in which the dependent fails to meet this Plan’s definition of a dependent; |

| 3. | The date the Trustees discontinue dependent benefits; |

| 4. | In the event of Your (the Participant’s) death, the end of the month in which Your death occurred, or |

| 5. | The date of the dependent’s death. |

KEEP YOUR RECORDS UP TO DATE

It is important that you give prompt written notice to the Fund Office of any changes that may occur such as change in address, marital status, birth of a child, death of a spouse, or the addition or loss of other insurance. Failure to do so may result in delay of payment of a claim at a future date or you will be held responsible for claims paid in error. In certain situations you may be required to submit proof, acceptable to the Trustees, to support your claim of an eligible Dependent.

The forms required in order to update your records can be obtained by calling the Fund office at 1-800-555-4959.

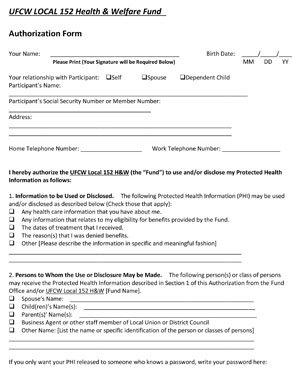

HIPAA AUTHORIZATION FORM

To provide you with the benefits to which you are entitled, the U.F.C.W. Local 152 Health and Welfare Fund (the “Fund”) must collect, create and maintain information about you. We at the Fund are concerned about the privacy of this information which is referred to as “Protected Health Information” or “PHI” under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”). To protect PHI, HIPAA requires health plans such as the Fund to set up new policies and procedures regarding how they use and disclose information about participants such as you.

The Notice of Privacy Practices that has been mailed to all members of the Fund’s health plans describes how the Fund may use and disclose Protected Health Information about you, as well as the Fund’s obligations and your rights with respect to that information. If you would like another copy of the Notice of Privacy Practices, you may request one by calling the Fund Office at 1-800-555-4959.

HIPAA establishes limits on those with whom the Fund can discuss your Protected Health Information when you are not present for the conversation. These limits include information regarding your eligibility and the eligibility of your covered dependents, treatment dates and the reasons for any denial of benefits. If you want to authorize the Fund Office to discuss this type of Protected Health Information with another person, including your spouse, or a business agent, or other staff member of a Local Union or District Council, you must complete the Fund’s standard Authorization Form. Generally, you will not need an authorization to obtain Protected Health Information about your minor children, with some exceptions. However, you will need an authorization to obtain Protected Health Information about covered dependents that are adults.

You may obtain additional information regarding authorizations by writing to Privacy Officer, Frank M. Vaccaro, Jr., Esq., 27 Roland Avenue, Suite 100, Mount Laurel, NJ 08054.

You may obtain additional information regarding authorizations by writing to Privacy Officer, Frank M. Vaccaro, Jr., Esq., 27 Roland Avenue, Suite 100, Mount Laurel, NJ 08054.

Click here for a Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) Form.

ADDITIONAL FORMS

Provided below are some additional forms, available for the convenience of our participants. If you don't see the form you're looking for, please call the Fund office at 1-800-555-4959 (prompt 2) to request one.

Adult Child Enrollment (and COB) Form

Adult Child Termination Request Form

College/Proof of Matriculation Letter